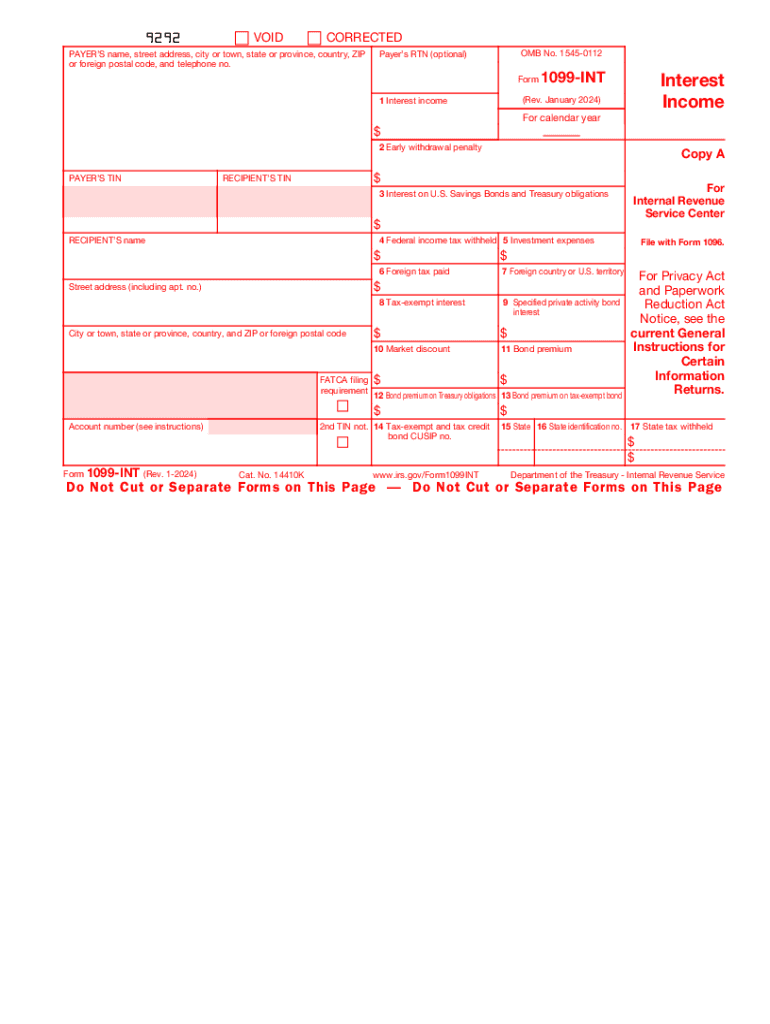

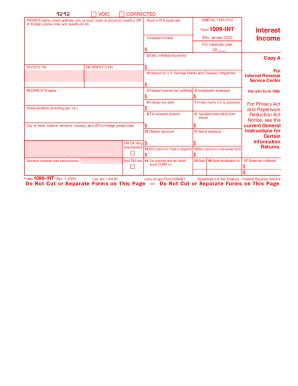

What is a 1099-INT?

Form 1099-INT is issued by banks and other financial organizations to report interest income. Interest reported with IRS 1099 INT includes the interest paid on saving accounts and U.S. saving bonds. It consists of both the interest earned and penalties on the investments incurred by the investor throughout the tax year.

Who should file form 1099 INT 2024?

Financial institutions must issue the 1099 INT form for:

- Those who received interest of more than $10 during the financial year, including interest paid on saving accounts, certificates of deposit, money market accounts, treasury bonds, interest-yielding accounts.

- Those who withheld and paid foreign tax on interest.

- Those who withheld and did not refund federal income tax under the backup withholding rules regardless of the payment amount.

One copy of 1099-INT is filed to IRS, while another copy is sent to the account holder.

What information does form 1099-INT contain?

In 1099 INT, you will find:

- the amount of interest you received;

- the amount of taxes withheld;

- if any of the interest is tax-exempt.

This information should be taken into account when filing your tax return.

Is form 1099-INT accompanied by other forms?

Whether you receive other forms along with 1099-INT depends on the types of income you’ve had throughout the year. You may receive the following documents:

- Form 1099-DIV, if you received any dividends except for dividends on your share account at the credit union;

- Form 1099-OID, if you bought notes, bonds, or other financial instruments at a discount of at least $10;

- Form 1099-R, if you took distributions from your retirement account, pension, a profit-sharing program, or annuity.

When is form 1099-INT due?

The recipient needs Copy B of the form by January 31, 2025. File Copy A with IRS by February 28, 2025, or by March 31, 2025.

Where do I send form 1099-INT?

Recipients of the 1099-INT form don’t need to file it with the IRS but must use the information when filing their tax returns. To view a 1099 INT sample, click Get Form above.